At FTI, we have worked with numerous organizations that are interested in solar energy generation for their facility. The desire for solar energy can come from several different goals that a company has. They may have long term environmental, social and governance (ESG) goals, they may want to cut down on their carbon emissions, or maybe they just want to start producing their own energy.

When companies are in this exploration phase, there are five key items to think about to ensure that your solar project and your final asset meet your energy production goals, and that this success is maintained over the life of the asset.

- It’s crucial to begin with an assessment of your facility to understand where you can save on your electricity spend. Things like LED lighting, building automation systems, passive ventilation, connected systems and charger management software are all great ways to cut down on monthly energy charges and start cutting carbon emissions, and typically have a good return on investment.

- Working with reputable company that understands the energy space is paramount, since the correct size of the system will determine the financial strength of the asset. Utilities typically have a net metering program, which means that the local utility will pay a customer the same amount per kilowatt hour that they charge you. If your solar overproduces during a day in the summer, you will be reimbursed at your kilowatt hour rate by pushing that energy to the utility. However, if your system is designed to be larger than the utility’s net metering maximum, any over production will be paid to you at wholesale rates, which could be anywhere from two to four times lower than your typical kilowatt hour rate. Utilities also have different tariff structures dependent on how much electricity each customer uses. Working with an organization that understands these tariffs and how to design systems to best fit them can mean a faster return on investment for your system.

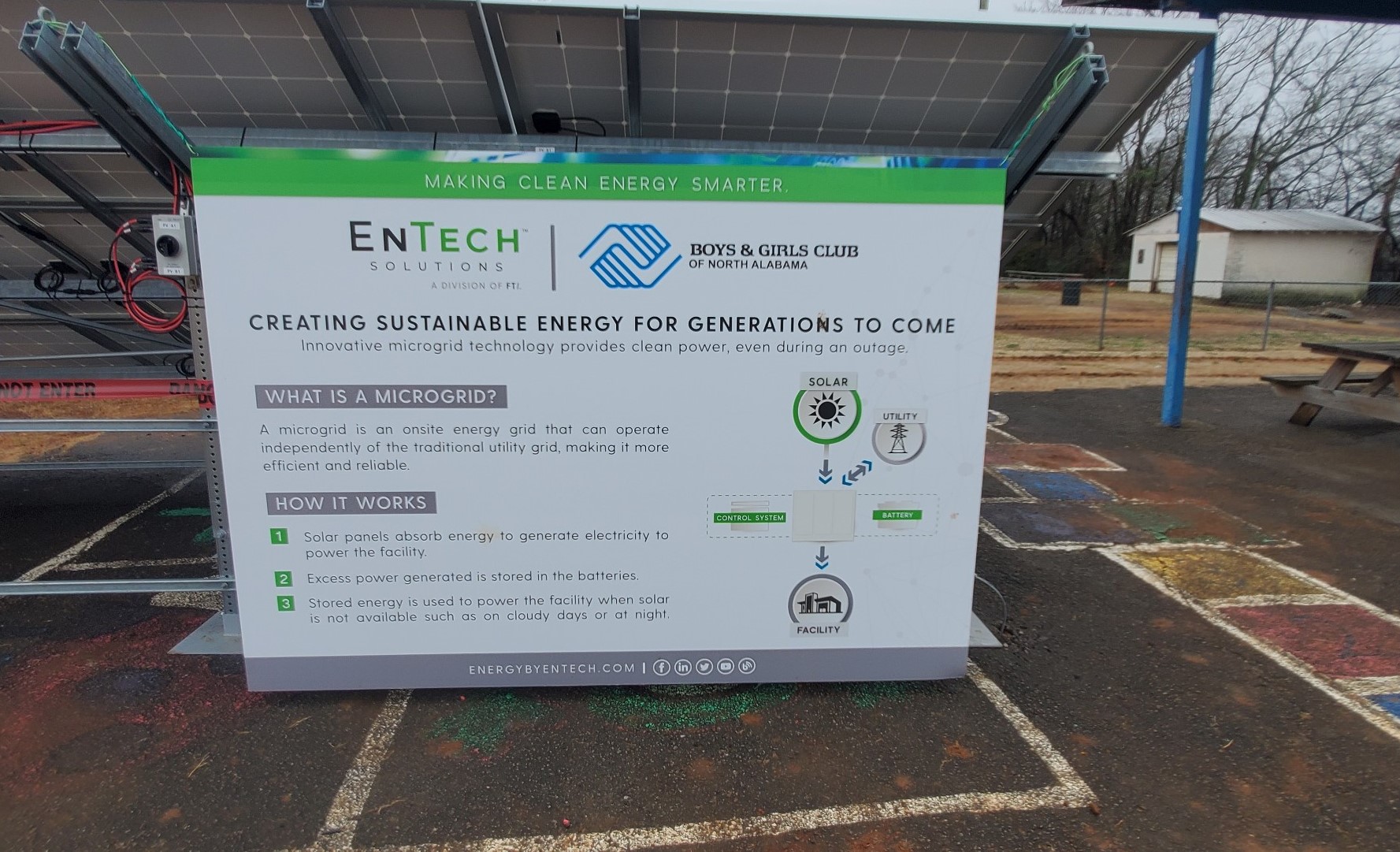

- It’s important to know that straight solar energy with no battery storage does not operate when the utility grid is interrupted. When the utility loses power, the inverters shut down to prevent electricity from back feeding. If you are looking for solar to produce resilient power apart from the utility, there are options available, and the system needs to be designed appropriately with battery storage options.

- Understanding tax incentives and how to navigate the Inflation Reduction Act are critical to the financial strength of the project. At FTI, we have energy experts dedicated to understanding guidelines around the IRA bill, as well as additional tax benefits available for energy communities, impoverished communities and American-made products. Working with a reputable company for engineering, construction and accounting could save you money on the front end of the project.

- Finally, it’s important to know who is going to maintain the system once it’s installed. Through our full-solution approach, we will look at monthly reporting to understand how the system is performing, working to optimize the system to ensure it’s operating at the highest level possible. Solar assets typically are in place and running for 25-30 years or longer. The financial strength of the project will depend on how well the asset performs over the entire life.

At FTI, we work closely with you to assess your energy needs and have proven solutions to help you meet your goals today and in the future. Contact us today to learn more.