In today’s corporate world, sustainability is more than a buzzword—it’s a competitive edge. A 2023 Deloitte study revealed that 27% of the respondents consider a potential employer’s position on sustainability before accepting a job. Many large companies are requiring their suppliers to become more sustainable to retain their business. There has been a pivotal shift in businesses quantifying the benefits of renewable energy projects beyond energy savings. So, what is the value of reducing your carbon footprint?

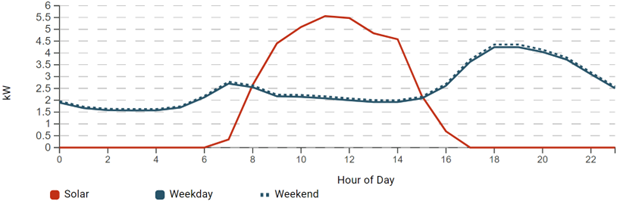

Consider a facility with solar on its rooftop. During the day it offsets all its electrical load from the solar energy produced and pushes some energy back to the grid. The following graph shows what this may look like.

Clean energy is sent back to the grid during the day, so when energy is pulled from the grid overnight, would it be reasonable to claim that this is clean energy? If so, this would result in a carbon-zero facility even though the daily and annual energy isn’t directly powered by the renewable source.

If we take this a step further, it’s feasible that the excess generation throughout the summer months can offset the utility usage in the winter months when solar generation is lower. This concept develops the framework around the idea that renewable energy generation not only produces energy which can be bought and sold at typical energy rates, but also has added value tied to its sustainability.

What if this same idea were applied to a solar array providing renewable energy to the utility hundreds of miles away from a facility desiring to claim renewable attributes; could you cite that renewable source to say that facility was run on clean energy? This is where Renewable Energy Credits (RECs) come into play.

RECs represent the environmental benefits of renewable energy generation and are actively traded in a voluntary market. Businesses that do not have enough available space or resources to install renewable energy systems to offset their usage, such as on a high-rise building, often purchase RECs to meet their sustainability goals.

A perceived issue with purchasing RECs, however, is the area of the country where the energy is produced. A REC produced in a coal-heavy region has a larger greenhouse gas (GHG) offset than a REC in a renewable heavy region.

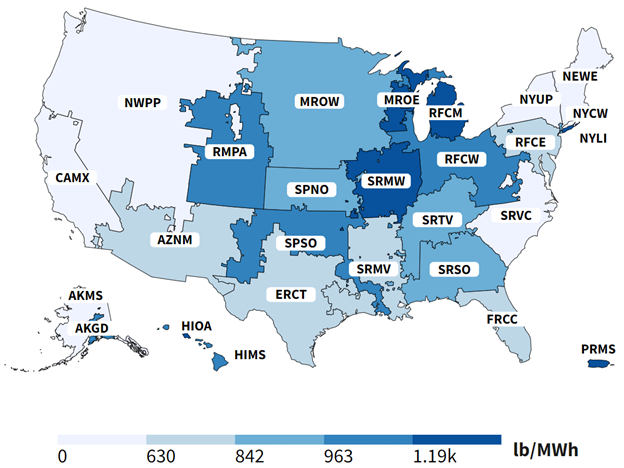

The map below depicts the EPA’s Emissions & Generation Resource Integrated Database (eGRID), a comprehensive source of data from EPA’s Clean Air Power Sector Programs on the environmental characteristics of almost all electric power generated in the United States.

As you can see, areas along the west coast generate cleaner electricity than the Midwest region of the country. If organizations in Wisconsin and California both purchased a REC for $100 to offset the GHG emissions of their facility, the Wisconsin REC buyer got a better deal per pound of GHG offset.

This is why some companies and policies are looking to the use of a Carbon Credits system instead. Carbon credits are permits that allow the holder to emit a certain amount of greenhouse gases; one credit is equivalent to one ton of carbon dioxide equivalent. While RECs are a way to claim renewable energy produced offsite, depending on the region, carbon credits can provide more value.

Keep in mind that RECs and carbon credits are a recurring cost. In order to claim the sustainability progress gained from buying these credits, you will need to continue to purchase them annually. Some risks associated with this include:

- Increase in facility loads which would require the purchase of more credits.

- Increases in the price of the credits may result in a decision against paying the added cost, losing the progress made.

- In a financial downturn, a difficult decision may have to be made between sustainability and funding other operational expenses.

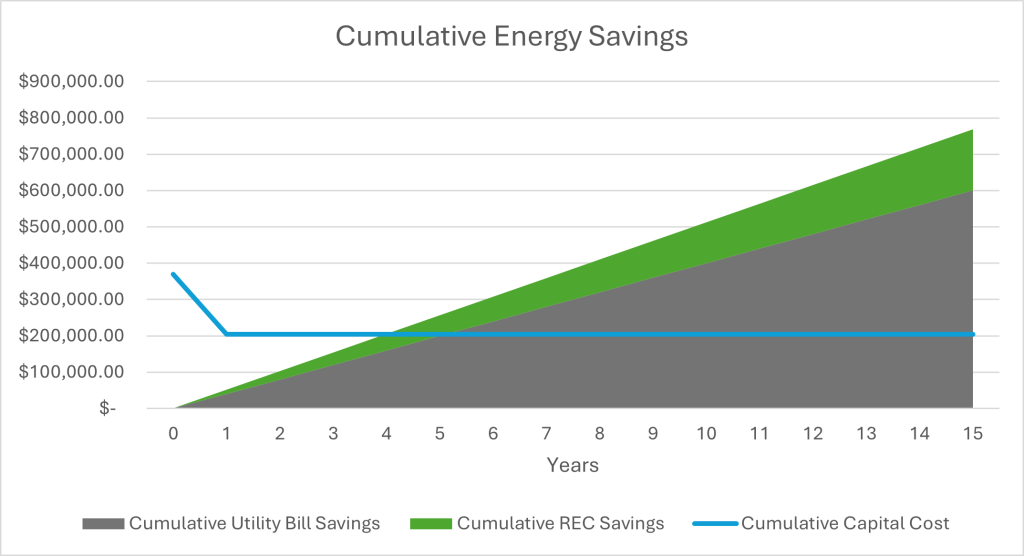

While carbon credits and RECs have a place in the energy landscape, they are viewed as avoided costs when you implement an on-site renewable energy source. Accounting for those avoided costs along with the additional cost saving benefits of adding on-site renewable energy can make implementation of renewable energy projects competitive with other capital projects.

Ultimately you will want to work with a trusted advisor on when RECs, carbon credits or on-site renewable energy generation are the most feasible and most economic option for the facility of focus.

At FTI, we help our clients work through the different options for meeting their energy needs and clean energy goals. By understanding the pros and cons of RECs, carbon credits and on-site renewable energy generation, businesses can not only meet their sustainability goals but also gain a competitive advantage in the marketplace. Let us help you navigate the complexities of sustainability planning and reaching your energy goals faster – contact us today.

If you enjoyed this blog article, please subscribe to stay up to date on the latest industry news from our experts at FTI.